Add a Payment Card to Your Account

Add a Payment Card to Your AccountManaging how you pay is easy in AI Ark. You can add one or more cards to your account and set any of them as default for future payments.

Why Add a Payment Card?

Why Add a Payment Card?Adding a payment method ensures your subscription renews without interruption and lets you manage billing seamlessly.

How to Add a Payment Card

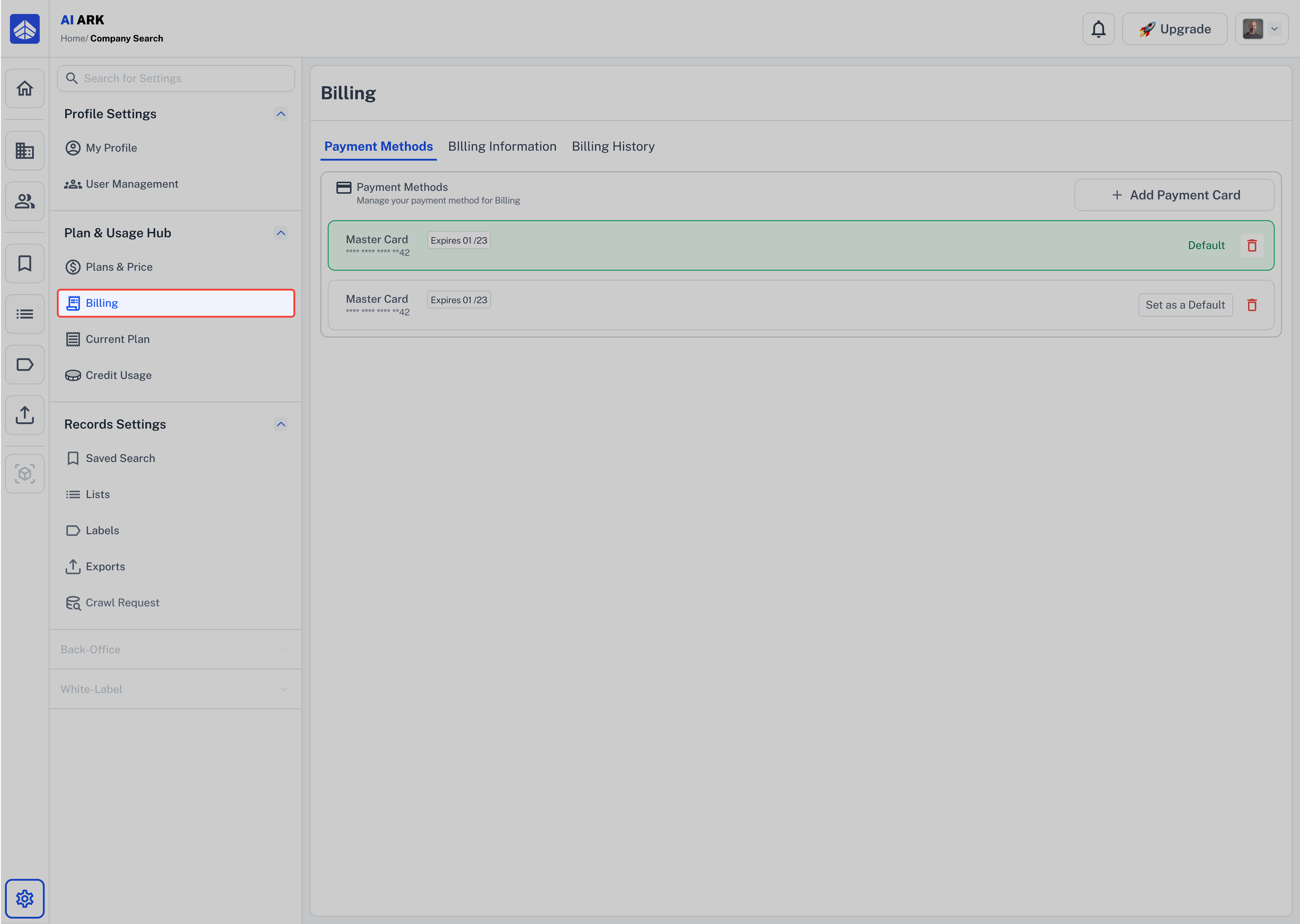

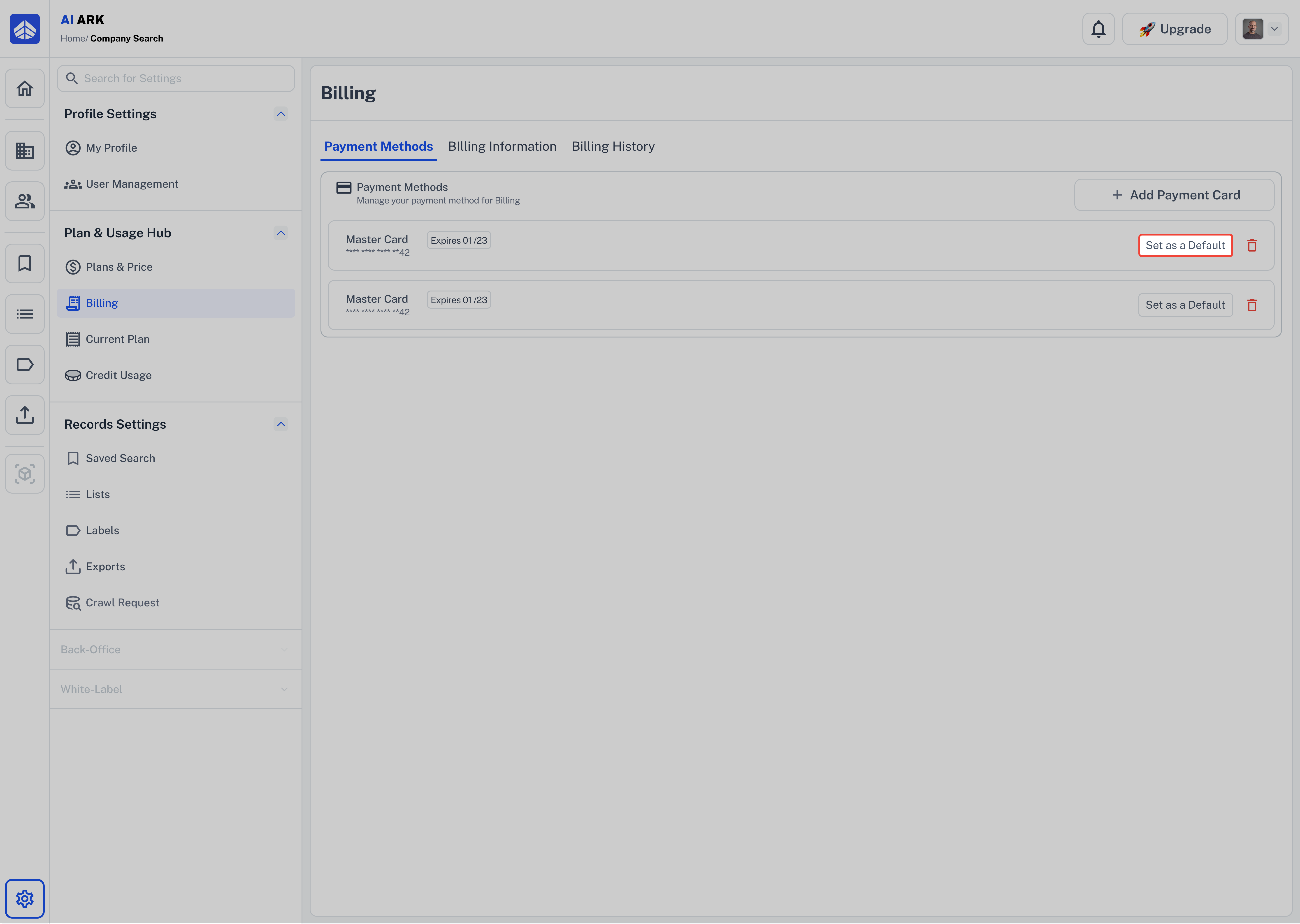

How to Add a Payment CardGo to Billing from the sidebar.

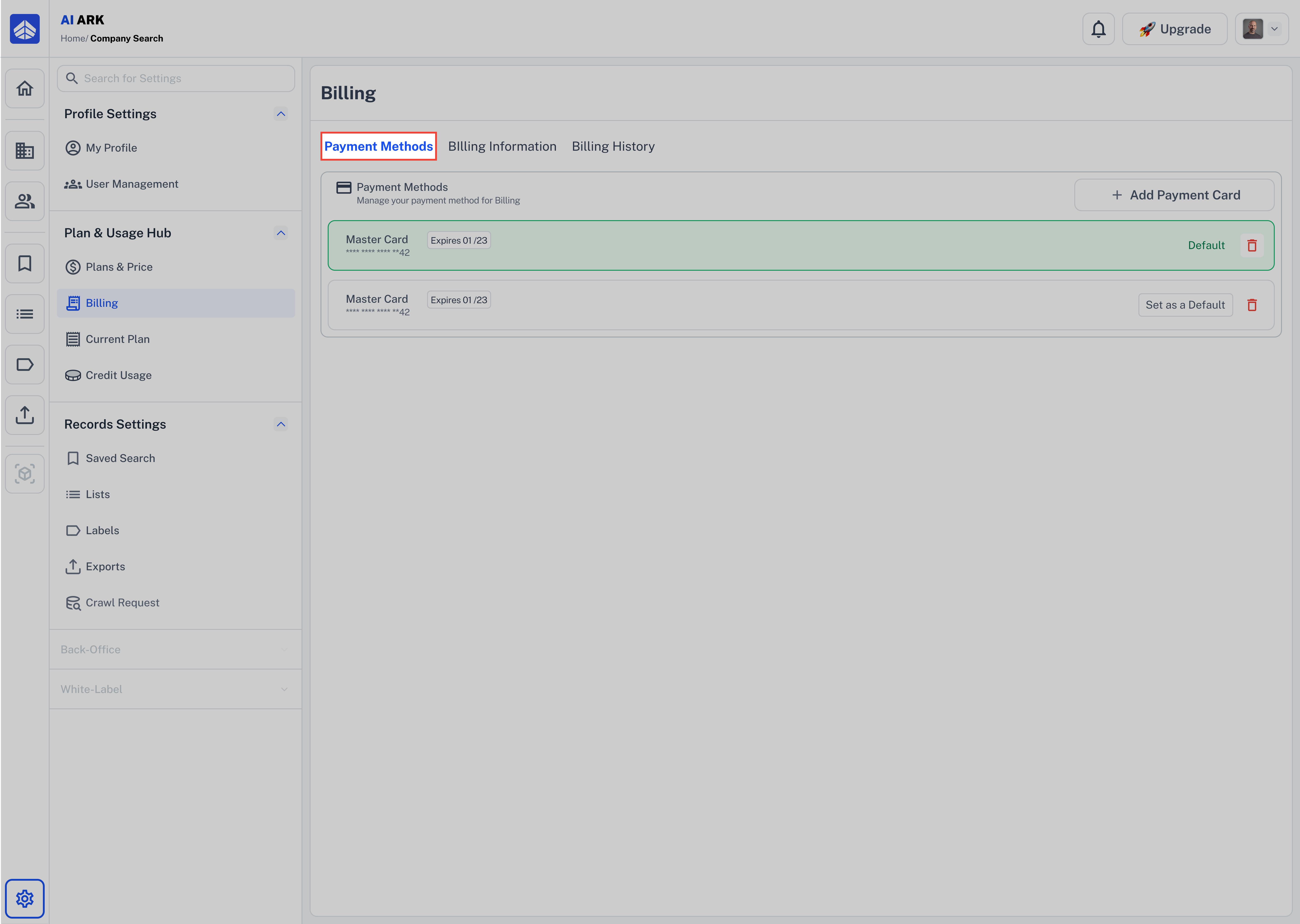

by default you can see Payment Methods tab.

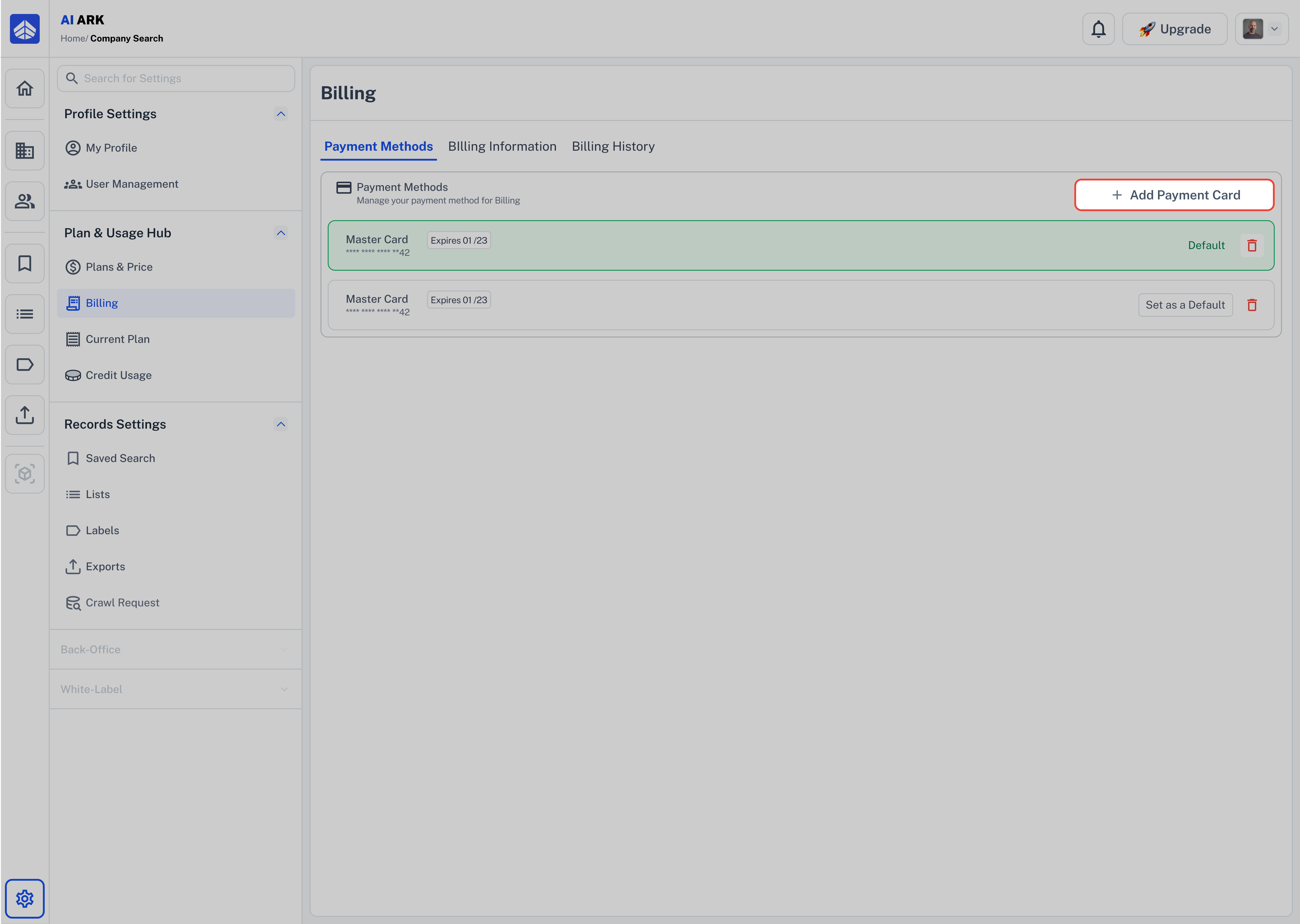

Click the “Add Payment Card” button at the top right.

Enter Card Details

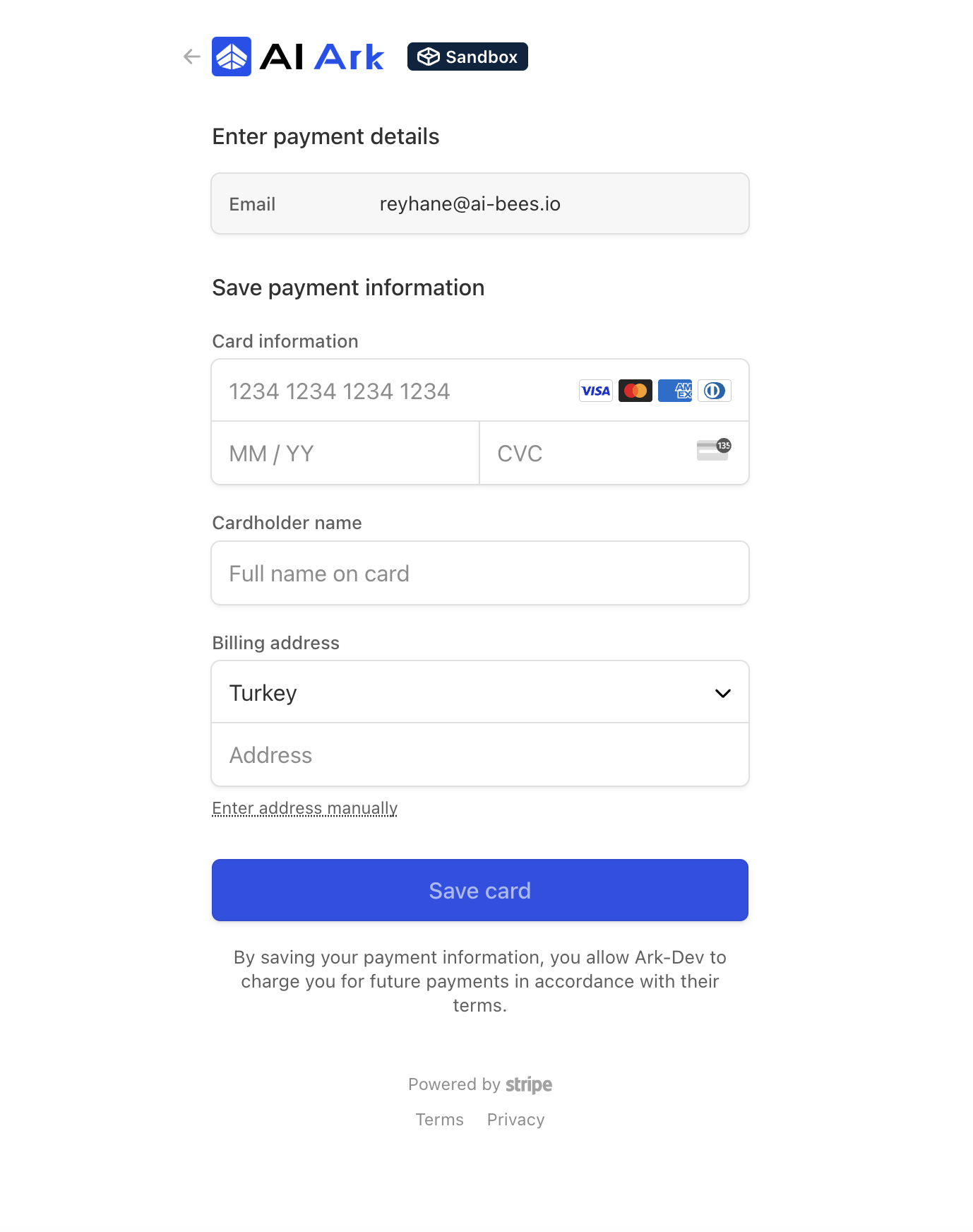

Enter Card DetailsA secure payment form will appear powered by Stripe.

Fill in the following:

Email address (pre-filled from your account)

Card Number, Expiry Date, and CVV

Billing Name (must match cardholder)

Billing Address (country + street address)

Save and Confirm

Save and ConfirmOnce all fields are filled:

Click “Save Card”

You’ll see a confirmation, and the new card will appear in your list.

To set it as default, click “Set as Default” next to the card.

Is It Secure?

Is It Secure?

Yes. All card details are encrypted and handled via Stripe, an industry-standard secure payment provider. AI Ark does not store your raw card details.

How to Set a Card as Default

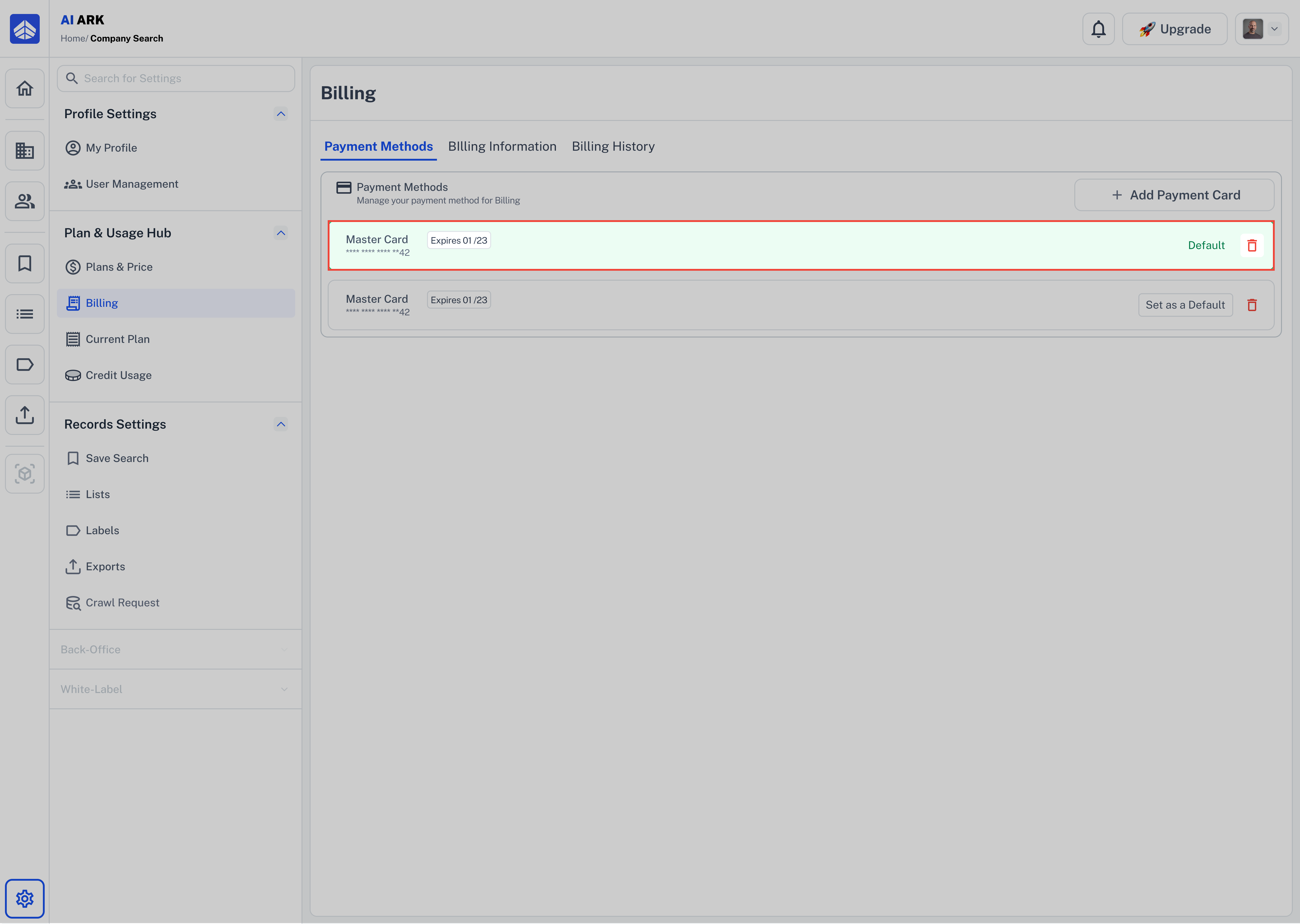

How to Set a Card as DefaultNavigate to Billing > Payment Methods.

In the list of saved cards, find the one you want to set as default.

Click “Set as Default” next to that card.

Once selected, a green “Default” label will appear on that card, and it will be used for future payments.

Once selected, a green “Default” label will appear on that card, and it will be used for future payments.

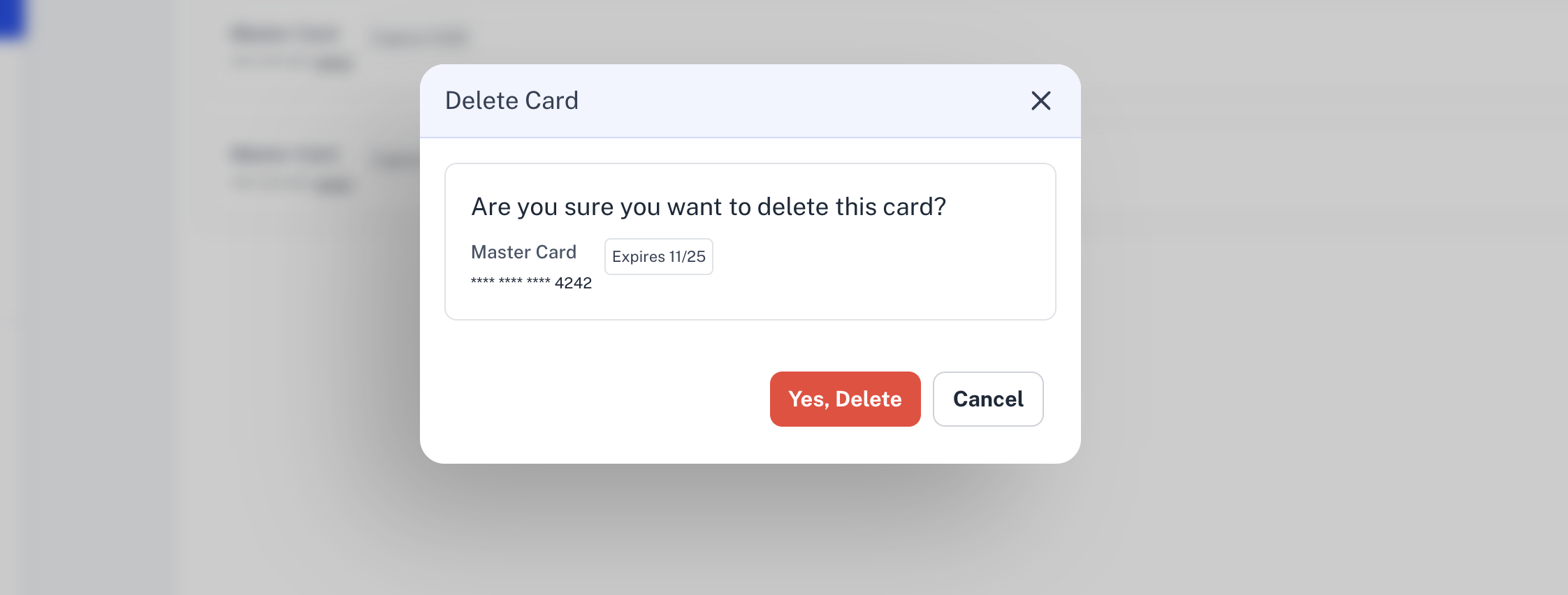

How to Delete a Card

How to Delete a CardHover over the card you want to remove.

Click the trash icon ( ) on the right side.

) on the right side.

Confirm deletion if prompted.

Why Update Billing Info?

Why Update Billing Info?Accurate billing info ensures your invoices reflect correct business details, which is essential for accounting, compliance, and tax reporting.

Steps to Edit Billing Information

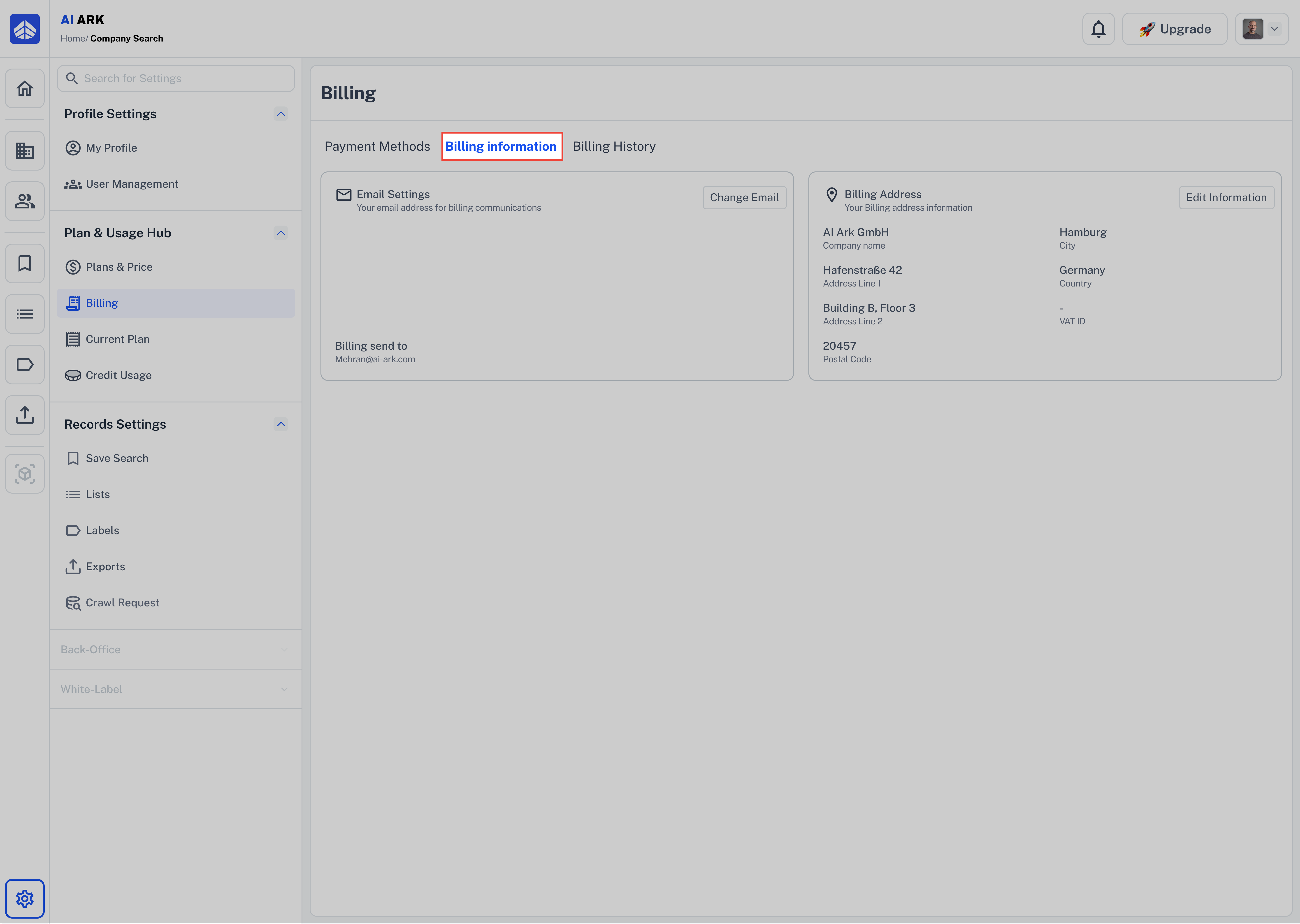

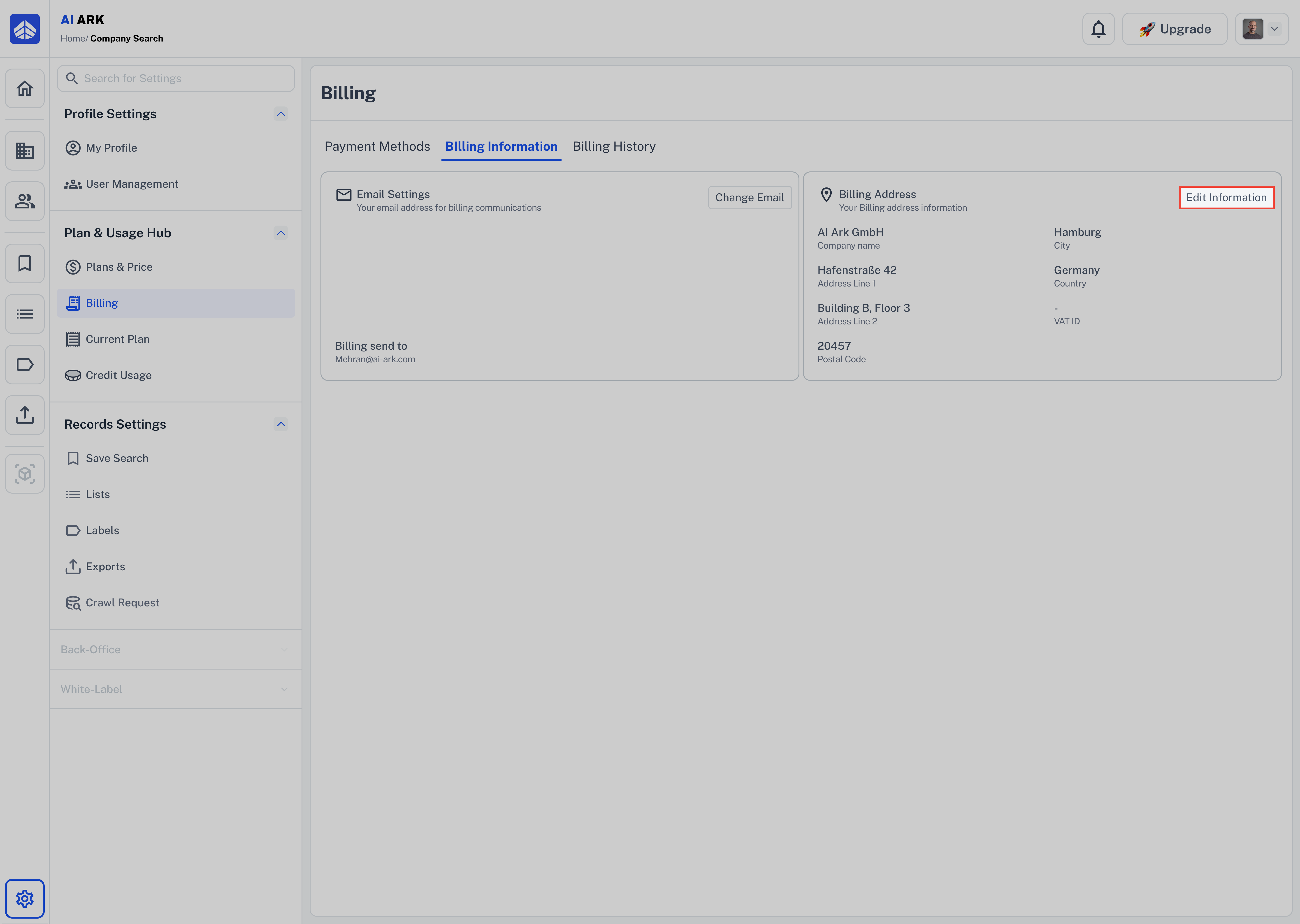

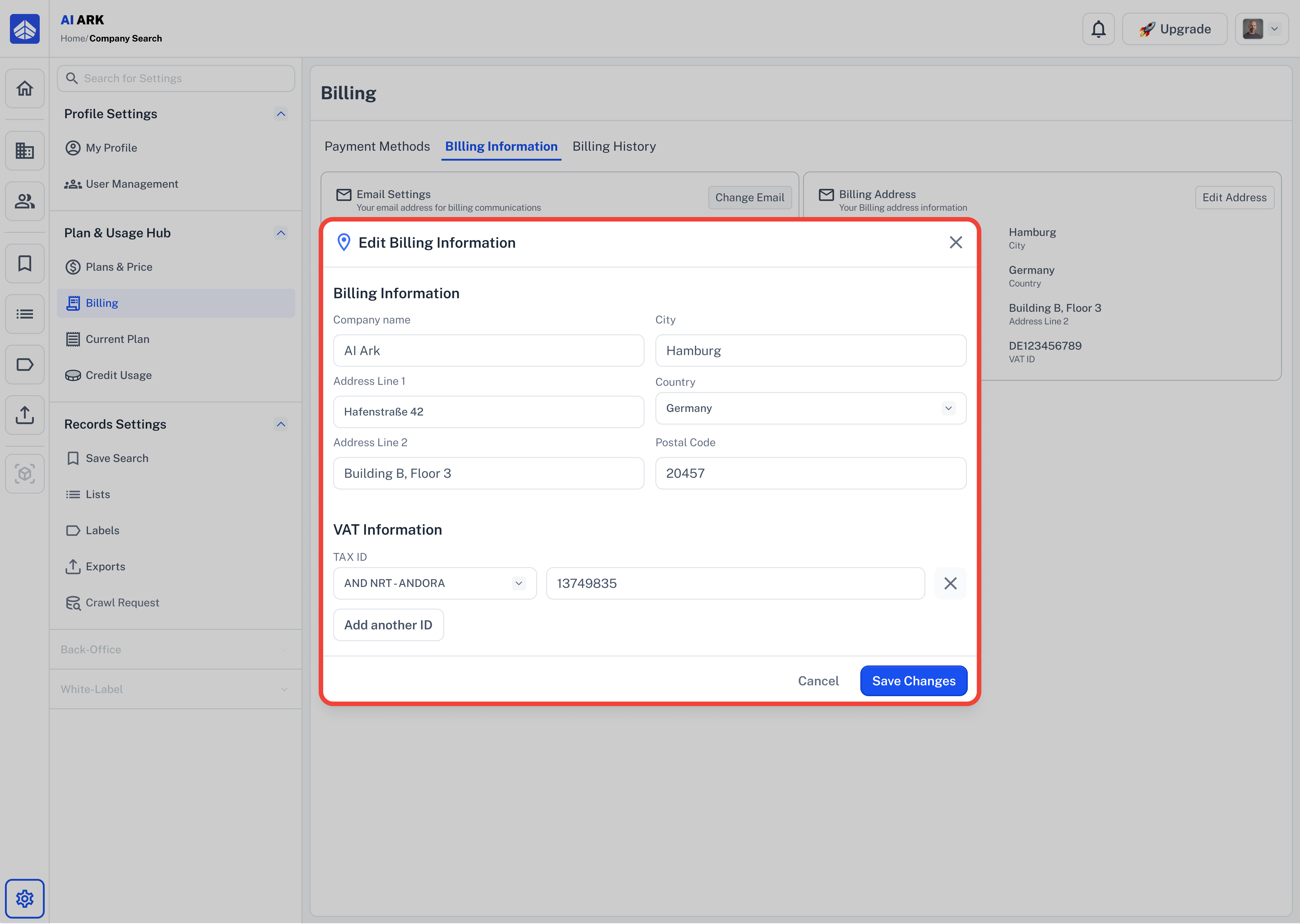

Steps to Edit Billing InformationGo to Billing > Billing Information tab.

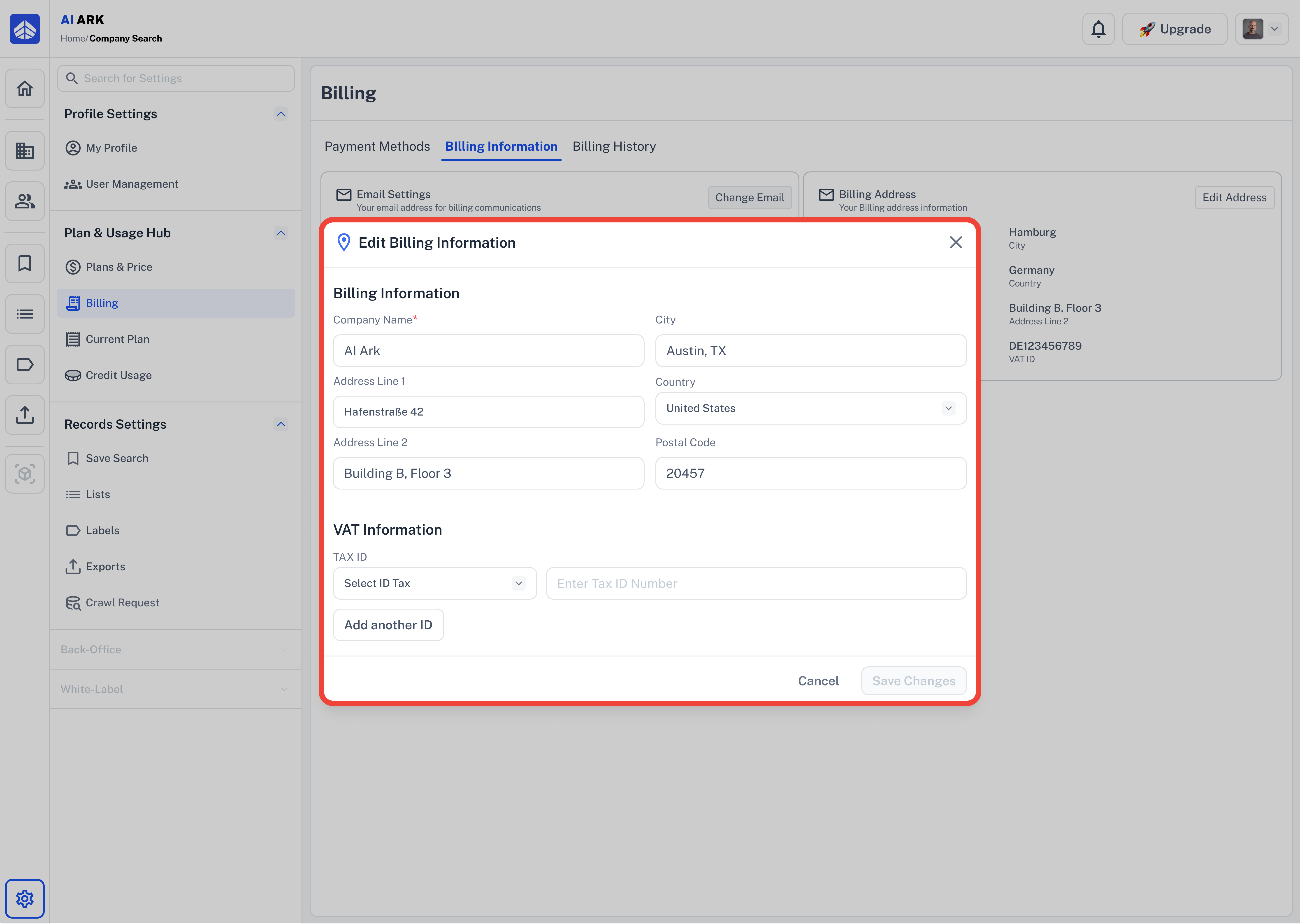

Click the Edit information button on the right side of the Billing Address section.

A pop-up window will appear with editable fields:

Company Name

City

Address

Country

Postal Code

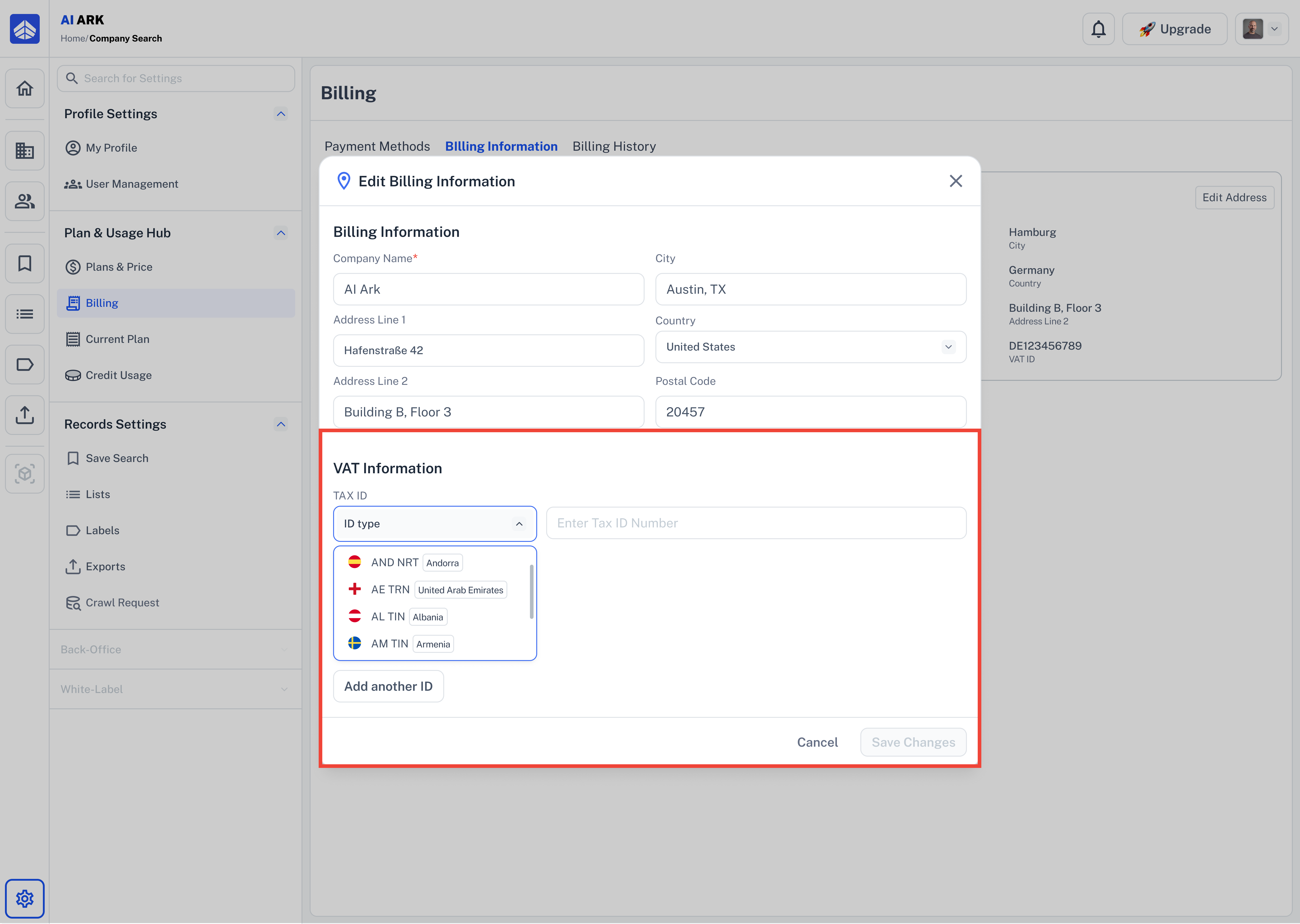

Under Tax ID, do the following:

Click the dropdown under ID type to select your country’s VAT type (e.g., ATU – Austria, DE – Germany).

Enter your VAT number in the input box next to it.

To add another VAT ID (for multi-country operations), click “Add another ID”.

Once you’re done, click Save Changes.

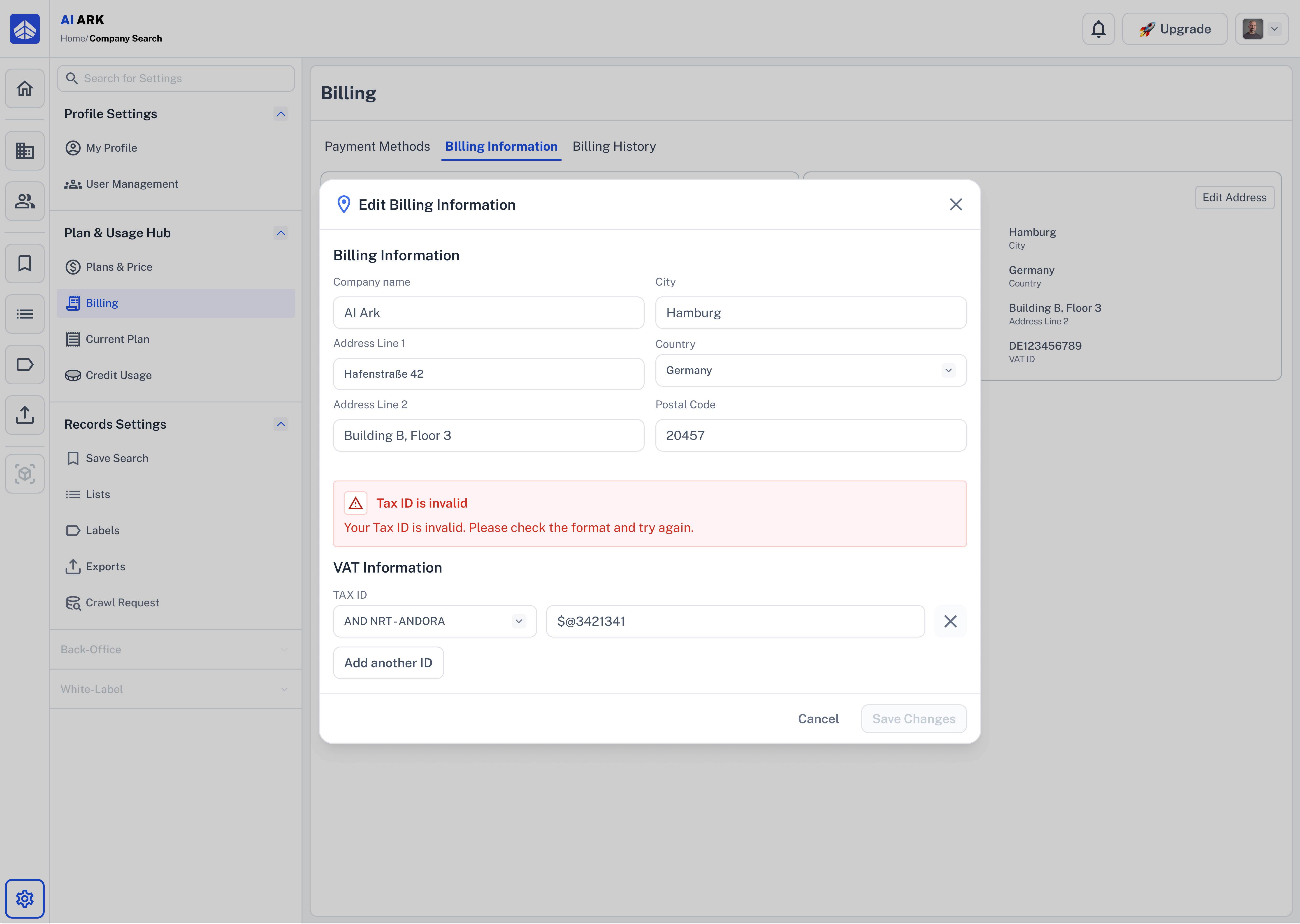

“Tax ID is Invalid” – How to Fix This Error

“Tax ID is Invalid” – How to Fix This ErrorWhen entering your VAT or Tax ID in the Billing Information section, you may see the following error:

How to Fix It?

How to Fix It?Check the selected VAT Country.

Make sure it matches the actual registration country of your business.

Remove any invalid characters.

Only numbers and letters are allowed in most VAT ID formats.

Example: 3421341 instead of $@3421341.

Validate the format.

Use an online tool like VIES (for EU VAT IDs) to check the valid structure.

For example, a German VAT ID should look like DE123456789.

Make your changes and click Save.

A confirmation message will appear once the changes are successfully saved.

Billing History – View & Download All Invoices

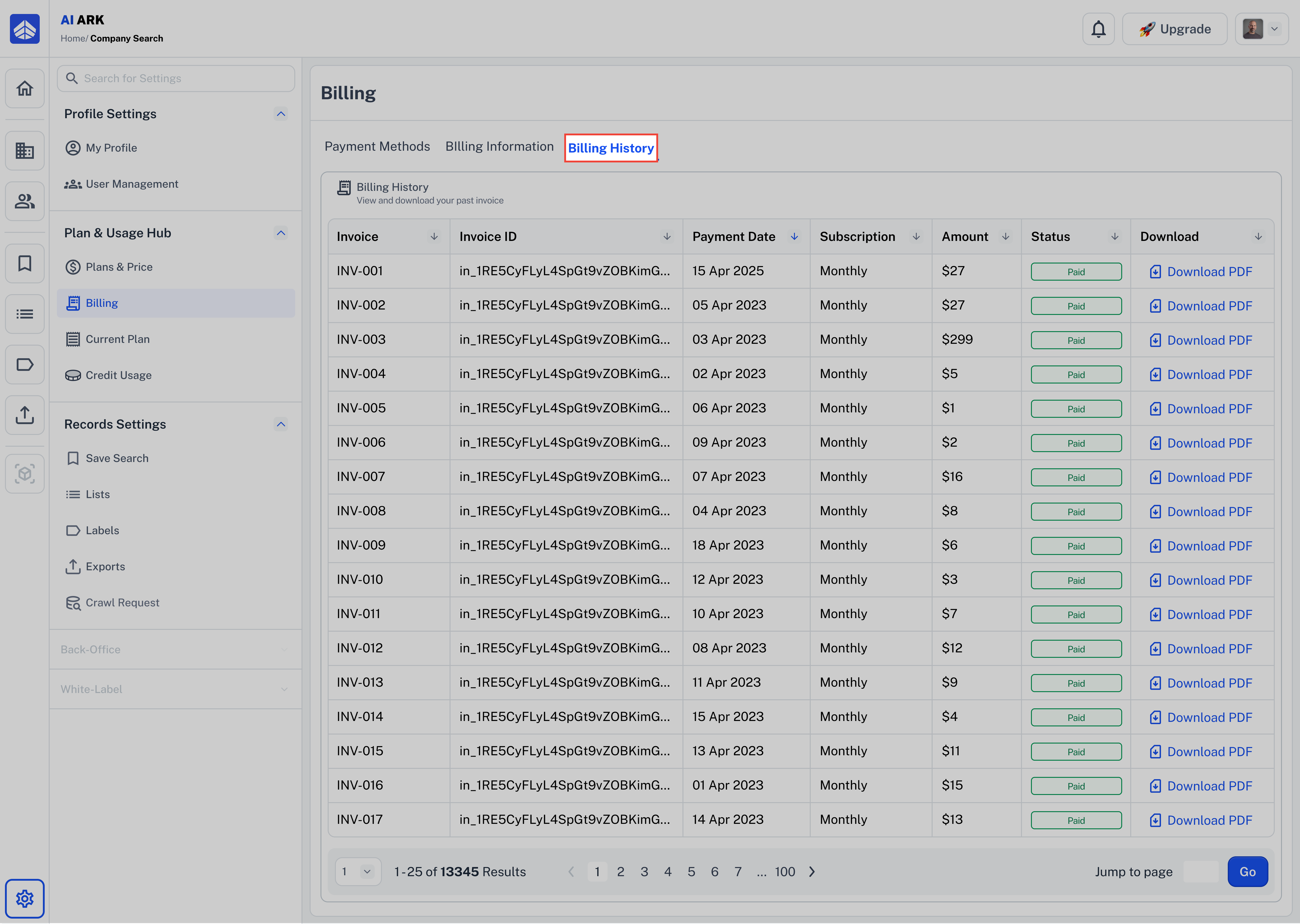

Billing History – View & Download All InvoicesInside the Billing section, the final tab—Billing History—gives you a clear view of all your past transactions.

This is where you can:

Quickly review your billing history

Quickly review your billing history

See exactly when and how much you were charged

See exactly when and how much you were charged

Download official invoice PDFs for accounting or reimbursements

Download official invoice PDFs for accounting or reimbursements

How to Get There

How to Get There Go to Billing in the left sidebar (under Plan & Usage Hub)

Go to Billing in the left sidebar (under Plan & Usage Hub)

Click on the Billing History tab (the last one)

Click on the Billing History tab (the last one)

You’ll see a full table of your past subscription records

You’ll see a full table of your past subscription records

Need Help?

Need Help?Click Contact Support—we’re ready to help any time.